Almost all doctors and hospitals in the United States accept Original Medicare, and you can click here to read all about this as well as Medicare as a whole. Under Medicare Part A and Medicare Part B-known as “Original Medicare”-the government pays providers directly for services received. Medicare consists of four parts that each cover specific services. Doing so can potentially save you hundreds of dollars a year. Health insurance makes up the bulk of this cost across all households.įor starters, it’s a good idea to seek out a broad understanding of everything Medicare covers (and doesn’t cover) before you retire. Healthcare-which includes health insurance, medical services, supplies and drugs-ranks third on the “biggest expenses” list for retiree households, who spend an average of $6,833 per year (or $569 per month) versus $5,193 for the average U.S. Alternatively, hailing rides from services like Uber or Lyft-especially if you don’t have daily car needs-can help you save compared to traditional car ownership.

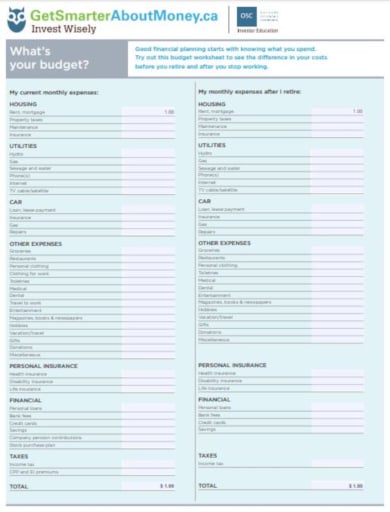

Shopping around annually for auto insurance is one of the best ways to save money. Since this category is often overlooked by many, having a meaningful discussion about the same is critical for retirees-especially when you consider that almost 80% of seniors over age 65 live in car-dependent suburban and rural communities according to Transportation for America, an advocacy organization. household when it comes to transportation costs. The average retiree household spends $7,492 a year ($624 a month) versus $10,742 ($895 a month) for the average U.S. This category includes vehicles, gas, insurance, maintenance and repairs, car rental, leases, payments and public transportation. While commuting expenses will undoubtedly shrink when you retire, not all transportation expenses will follow suit. It’s not uncommon for sellers to reap less than what they had originally anticipated. If you decide to go this route, just ensure you receive a realistic estimate of what your home is worth and factor in closing costs and taxes. Alternatively, you can look into downsizing your home to completely sidestep any mortgage debt. Paying off your mortgage and building equity prior to fully retiring is not only a good first step but one of the smartest things you can do to keep your living expenses in check after you stop working-giving you more breathing room when it comes to other costs. In contrast, 34% of those aged 65-79 (and 3% of those aged 80+) had mortgages in 1990, so it’s obvious that Americans today have less aversion to debt than they did just a few decades ago. Moreover, according to an American Financing survey, many respondents believe they may never pay off their mortgage. household spends $20,679 annually ($1,723 per month) on housing, representing approximately 33% of total annual expenditures.Ī recent Harvard University Joint Center for Housing Studies report claims that 46% of homeowners between the ages of 65-79 (and one in every four people aged 80+) are still paying off a mortgage. More specifically, the average retiree household pays an average of $17,472 per year ($1,456 per month) on housing expenses, representing almost 35% of annual expenditures. Housing-which includes mortgage, rent, property tax, insurance, maintenance and repair costs-is the largest expense for retirees.

Retirement budget planning how to#

Here’s a list of the biggest expenses the average household encounters during retirement and some tips on how to minimize them. While some expenses such as payroll taxes (if you’re not working), commuting costs and disability insurance often disappear in retirement, many others do not. By comparison, the average annual spend across all households is $63,036. Bureau of Labor Statistics, the average retiree household (led by someone age 65 or older) spends $50,220 per year. While this may be true in many cases, the spending difference is not as significant as one may think.Īccording to the latest Consumer Expenditure Survey from the U.S. One major assumption people have about retirement is that they’ll spend less than they did before they hit this milestone.

0 kommentar(er)

0 kommentar(er)